Cuyahoga County EITC Coalition Evaluation

August 19, 2013

Cuyahoga County EITC Coalition Evaluation

August 19, 2013

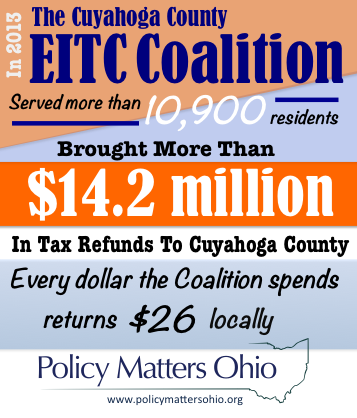

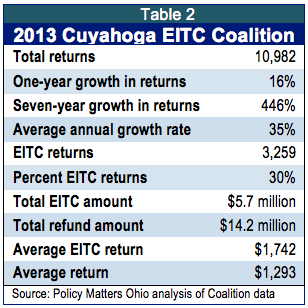

Download report (16 pp)Download summary (1 pg)Press releaseThe EITC Coalition served more than 10,900 residents in 2013, and brought more than $14.2 million in tax refunds to Cuyahoga County.

Executive Summary

Led by Enterprise Community Partners, the Cuyahoga Earned Income Tax Credit Coalition (the Coalition) was established in 2005 to provide free, high-quality tax assistance services in Cuyahoga County. The Coalition provided services to nearly 11,000 clients last year, more than 3,200 of whom got the Earned Income Tax Credit (EITC). With more than 40 partners, the Coalition brought more than $14.2 million in federal and state tax refunds to Cuyahoga County in 2013 for tax year 2012. It works by helping all sorts of greater Clevelanders file their taxes, and by helping individuals and families who earn up to $50,270 claim the EITC. This report analyzes the Coalition’s free tax program and summarizes a survey we conducted of Coalition clients. We surveyed more than 2,700 clients and found that the EITC will help clients pay for essentials. Other findings include:

Led by Enterprise Community Partners, the Cuyahoga Earned Income Tax Credit Coalition (the Coalition) was established in 2005 to provide free, high-quality tax assistance services in Cuyahoga County. The Coalition provided services to nearly 11,000 clients last year, more than 3,200 of whom got the Earned Income Tax Credit (EITC). With more than 40 partners, the Coalition brought more than $14.2 million in federal and state tax refunds to Cuyahoga County in 2013 for tax year 2012. It works by helping all sorts of greater Clevelanders file their taxes, and by helping individuals and families who earn up to $50,270 claim the EITC. This report analyzes the Coalition’s free tax program and summarizes a survey we conducted of Coalition clients. We surveyed more than 2,700 clients and found that the EITC will help clients pay for essentials. Other findings include:

- The Coalition continues to grow, bringing substantial resources to Cuyahoga County. In 2013, it served 10,982 clients, more than 3,200 of whom received the EITC;

- In total, these efforts brought $14.2 million in federal refunds to the county. EITC claims alone brought in more than $5.6 million;

- The Coalition serves people who have not claimed tax credits before and helps them avoid exploitative fees: roughly 12 percent paid for tax preparation in prior years and 12 percent did not file in the previous year;

- Clients are satisfied with the services: more than half were return customers, 92 percent were happy with their service and 91 percent said they would return again;

- The effort is relieving poverty for working families: the 30 percent of clients who got the EITC received $1,742 each on average;

- For every dollar spent on Coalition costs, $26 in state or federal dollars is brought back to Cuyahoga County, much of which is spent in local communities.

Two recent policy changes have improved the situation for EITC filers, and additional policy reform could build on that. Federal regulation has made it difficult for banks to sell exploitative Refund Anticipation Loans, essentially eliminating them in tax year 2012. Similar regulation and better disclosure could help eradicate other predatory products. Ohio lawmakers, in the spring of 2013, put in place a small non-refundable Ohio EITC. This bipartisan initiative will benefit low-income taxpayers in Ohio, and is a good starting point for a stronger state EITC.

In short, the report found that the Coalition’s efforts are bringing new federal money into the economy, relieving poverty, reducing the use of predatory loans and doing a good job with technology and customer satisfaction. It is crucial that we devise ways to help bring the project to scale so that it is serving a larger portion of the community.

Introduction

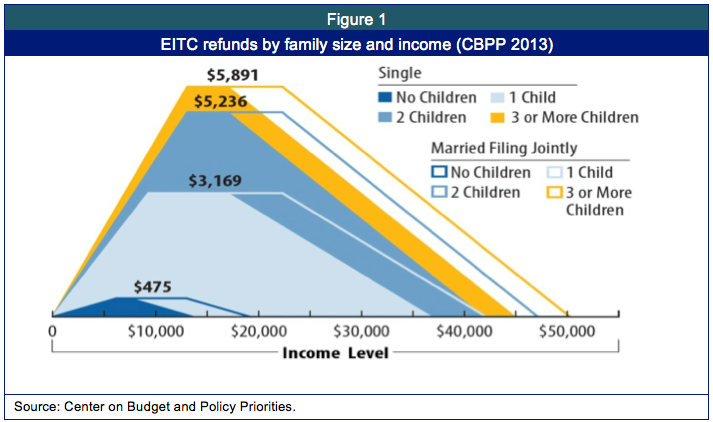

The Cuyahoga EITC Coalition, led by Enterprise Community Partners, is a group of social service agencies, community groups, and government entities that provides free tax preparation for low- and middle-income families. During last year’s tax season, the Coalition prepared 10,982 tax returns and secured more than $14.2 million in federal dollars for Cuyahoga County residents. Slightly less than one third of clients (30 percent) received the Earned Income Tax Credit (EITC), a refundable federal tax credit that primarily assists low-and moderate-income working families with children. The EITC provides a maximum of $5,891 to a low-income family of three with a working parent.

Figure 1 shows the structure of the EITC. The maximum credit is for working families with three or more children earning between $13,000 and 23,000.[1] These families are eligible for $5,891, as the solid yellow line shows. Families with two children can get a maximum of $5,236 (blue line) and those with one child get a maximum of $3,169 (light blue line). A modest credit is available to very low-income workers with no children, as shown by the bottom darker blue line.

The EITC, available only to low-and moderate-income families who work and pay taxes, is now the nation’s largest poverty relief program. It was created in part to help make up for the fact that state and local taxes fall more heavily on low-income families and expanded in part to make up for limitations placed on other kinds of cash assistance. It is structured as a refundable credit: if the credit exceeds the amount owed, the IRS sends a refund check or direct deposit in the amount of the difference.

In tax year 2011, the most recent data available, the EITC provided more than 975,000 Ohio families with total refunds of $2.14 billion.[2] Nationally it lifted an estimated 5 million children above the federal poverty line, dwarfing other poverty prevention programs. It also helps the near-poor to get a little further above the poverty line, which can be crucial as the poverty line ($23,550 for a family of four) is widely considered inadequate for meeting basic needs. The Coalition helps working families claim this and other tax credits for which they are eligible. As a community, we have an interest in making sure that Cuyahoga County residents get the benefits that the federal government provides.

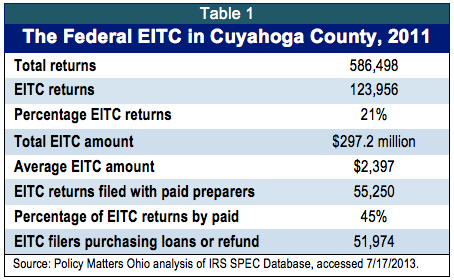

In Cuyahoga County, the EITC provides significant assistance to working families (see Table 1). More than 120,000 families claim the credit, bringing over $297 million to the county.

In Cuyahoga County, the EITC provides significant assistance to working families (see Table 1). More than 120,000 families claim the credit, bringing over $297 million to the county.

Families are often unaware of the EITC, claim it incorrectly, or pay to have their taxes filed, diluting their refund. The IRS and Government Accountability Office estimate that up to 25 percent of eligible EITC filers do not claim the credit.

Free tax preparation assistance from the Coalition and Ohio Benefit Bank helped more families claim the credit, e-file their return, and avoid paid preparers. Easy e-filing also contributed to less use of paid preparers. Between tax years 2009 and 2011, even though more families claimed the EITC, there was an 8 percent drop in the share of EITC returns prepared by paid preparers in Cuyahoga County. The Coalition and Ohio Benefit Bank have increased their number of sites and territory covered for free tax preparation, including inner-ring suburbs around Cleveland.

Still, many low-income working families use paid tax preparation, which can cost anywhere from $100 to $400 per refund. Table 1 shows that in Cuyahoga County in 2011 (the most recent data available), 45 percent of EITC filers paid for tax preparation.

Victory on refund loans

In a positive development for tax filers, predatory tax refund anticipation loans (RALs), sold by banks, have been virtually eliminated. These short-term, high-interest loans provided quick payment of anticipated refunds. RALs sped up the return process slightly, getting filers a portion of their refund in a few days, but diverted money intended for low-income filers into the pockets of paid preparers. Filers usually paid for the loan by having that portion deducted from their refund and often didn’t realize that they were purchasing an additional product because preparers built the cost into the price of preparation and did not explicitly disclose the actual fees being charged.

For decades, consumer advocates fought to better regulate RALs with limited success. In the past few years, however, better regulation finally ended the practice of refund loans. Three changes were crucial: banks that accepted funds under the Troubled Asset Relief Program (TARP or the bank bailout), were required to carry loans on their own books instead of keeping them off their books as they’d previously done. Second, the federal government began requiring better disclosure and forbidding some forms of deceptive advertising. Finally, in 2010, the IRS stopped providing free credit checks to RAL providers – these checks had allowed those peddling refund loans to know in advance that the client’s loan was guaranteed, essentially making these loans risk-free for the lenders. These three reforms led to the near elimination of exploitative refund loans.[3]

Unfortunately the industry has begun selling Refund Anticipation Checks (RACs), which allow a client to pay for tax preparation using their refund and receive a paper check minus that amount in several weeks. They are not as costly as RALs had been, but they typically cost between $30 and $55 and do not get filers the refund any sooner, although they delay payment for the cost of preparation until the refund arrives.[4] A recent report found that preparers are selling RACs to more consumers than ever bought RALs, although the overall cost to consumers is much lower.[5]

In tax year 2011, the most recent year for which we have data, more than 284,000 Cuyahoga County residents paid to have their taxes prepared and more than 78,000 of them bought Refund Anticipation Checks.[6] Because of the lost revenue from tax loans, many paid preparers have raised the prices on preparation itself – leading to an increase in RACs to cover those costs. Nationally that year consumers paid approximately $338 million to get their refunds slightly earlier, essentially borrowing their own money.[7] In previous years when the volume of RAL’s was larger, this amount would have been much higher.

Coalition overview

The Coalition brings substantial federal revenue into Ohio, works effectively, and helps county residents. Sites that prepare taxes do so under the federal Volunteer Income Tax Assistance (VITA) program. IRS-trained and certified volunteers prepare federal, state, and local taxes for all kinds of filers, not just those claiming the  EITC.[8] The number served by the Coalition has grown steadily at about 35 percent a year and provides a solid benefit to clients. The average client’s total refund was $1,293 and the average EITC client return was $1,742.

EITC.[8] The number served by the Coalition has grown steadily at about 35 percent a year and provides a solid benefit to clients. The average client’s total refund was $1,293 and the average EITC client return was $1,742.

In 2013, the Coalition continued with its previous growth and outreach efforts, such as partnering with financial institutions, while adding new initiatives to reach Spanish-speaking residents and to align services with what past surveys had found clients needed. Some new initiatives included:

- Working with the Spanish American Committee for a Super Saturday event that included Spanish translators, courses in financial literacy, and one-on-one sessions for clients;

- Providing those who were qualified and interested with assistance on the student financial aid form known as FAFSA; and

- Coordinating with organizations to integrate free tax preparation with financial services, foreclosure prevention, homeownership workshops, food assistance, budgeting, saving and help with other family needs.

Although the Coalition serves more people each year, only 2.6 percent of Cuyahoga County EITC claimants used the Coalition’s services in 2013 (for taxes paid on income in 2012). Nationally, around one percent of all EITC returns are prepared by free tax coalitions, so small as it is, Cuyahoga County’s coalition is helping a greater share of county residents than is typical nationwide. Some previous studies using focus groups and surveys suggest that the main reason for not using free tax preparation is that clients don’t know about these services or perceive paid preparers as getting them more money. Better funding would enable this cost effective service to reach more people.[9]

Survey methodology

The Cuyahoga EITC Coalition commissioned Policy Matters Ohio to conduct an evaluation. Ten VITA sites distributed a survey and 2,713 clients participated. Clients were not required to fill out the survey to receive assistance and did not have to answer every question. The goals of the survey were to understand which marketing efforts work, how free tax services affect lives, and how clients make financial choices. We were also interested in exploring financial behavior to understand the best ways to incorporate asset building into Coalition efforts.

Survey results

Figure 2 displays the top 10 zip codes of respondents. Although residents came from all over the county, all of the top zip codes are in the inner city of Cleveland.

Of the 2,713 survey participants, 38 percent had not used free tax services prior to this tax season. More participants were return clients this year than in any of the five previous evaluation years and 91 percent said they would return again. Figure 3 displays how clients prepared their taxes the previous year. Twelve percent of participants had previously paid to have their taxes done, a decrease from last year’s 16 percent. The share that had not filed the previous year dropped from 14 to 12 percent, and the share of that group who had never previously filed dropped from 5 to 2 percent. Many who hadn’t previously filed were of an age where they likely were not required to file earlier (recent high school or college graduates, for example). Tax compliance, in addition to EITC outreach, is one of the main purposes of the VITA program, and each year, there are fewer clients who haven’t filed in previous years. VITA sites are also able to file returns for up to three past years, meaning many clients are getting help for past taxes.

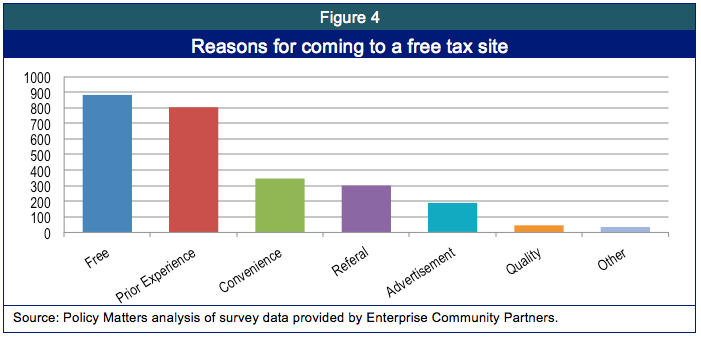

While clients heard about the Coalition in various ways, word of mouth was the most common. More than 1,100 clients heard about the Coalition from friends and families. The largest increase came from the 530 clients who reported hearing about free tax preparation from a social service organization. Clients also learned about free tax preparation through flyers, posters, and radio and print advertisements. Most clients use the direct referral line of 2-1-1, First Call for Help, which is mentioned in most marketing material.

Figure 4 shows clients’ reasons for using Coalition tax services. The fact that the service is free tops the list. In close second this year was prior experience with a VITA site.

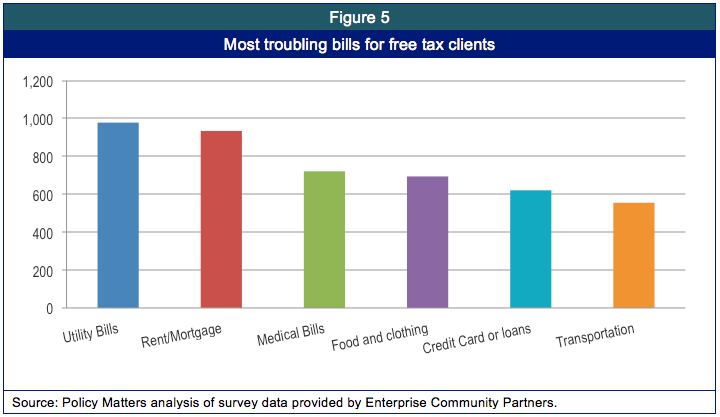

Figure 5 shows responses clients gave when asked which issues were most troubling to their family. As with last year, utility bills (978) and housing costs (934) were named the most challenging economic issues. Both are issues many clients included in plans for how to spend their refund.

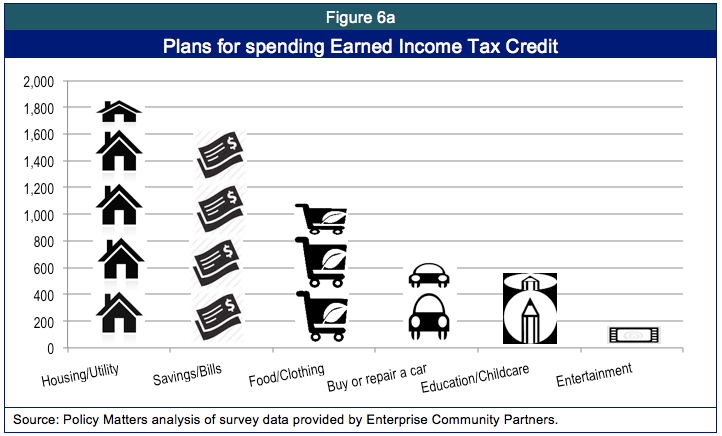

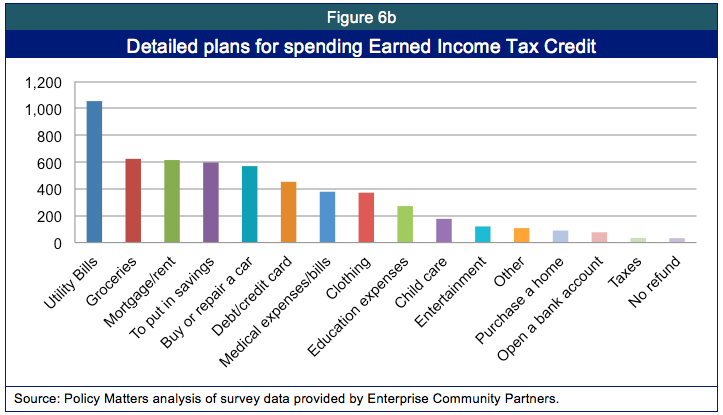

Clients indicated that they use their refunds on essentials, often purchased in the community. In Figure 6a we collapsed the various categories that clients included to give an overview of how they plan to spend refunds. Nearly all said they would spend the refund on necessities like housing, savings, food, or transportation. The number of clients citing each area is on the vertical axis.

Figure 6b gives a more detailed description of spending plans.

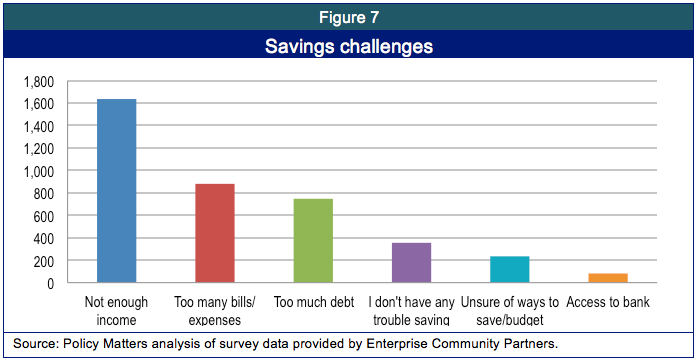

Most clients reported difficulty earning enough to meet basic needs, making saving difficult. (See Figure 7.) More than 1,600 clients said they did not earn enough to save. This was more than 60 percent of total survey respondents. Other clients said that they had too many bills and too much debt to save. Few clients said that they did not know the best ways to save. This information can help the Coalition improve coordination with other efforts such as the Cleveland Saves program.

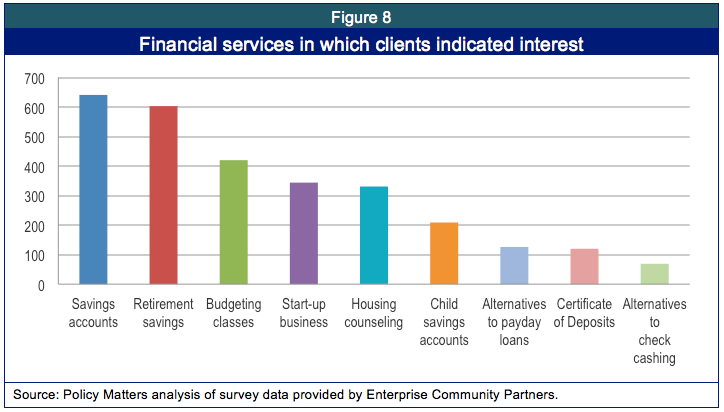

The survey examined which free financial services clients would be most interested in. As seen in Figure 8, saving and asset building is a top priority: savings accounts, saving for retirement, or saving for a child. Unfortunately, many who voiced interest in retirement savings were already nearing or in retirement age. This suggests that while interest in saving is high, the capacity to do so is limited. We also found significant interest in learning how to maintain a budget and starting a business.

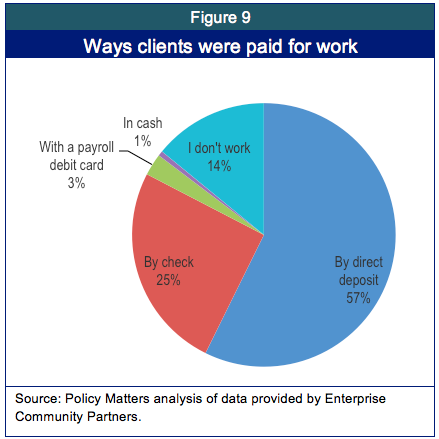

The survey also reveals that most clients (57 percent) are paid through direct deposit into bank accounts, which means they are eligible for quicker refunds from the IRS when they e-file (see Figure 9). After last year’s startling jump in the number of respondents who reported being paid in cash, this year’s reports have returned to the earlier low level (1 percent for this year), indicating that last year’s jump was atypical. What is significant, however, is the number of people who reported not working at all. While this 14 percent includes many seniors past retirement age, Ohio’s high unemployment rate is likely also a factor. EITC recipients must work to earn the credit, so non-working tax preparation clients do not qualify for the EITC.

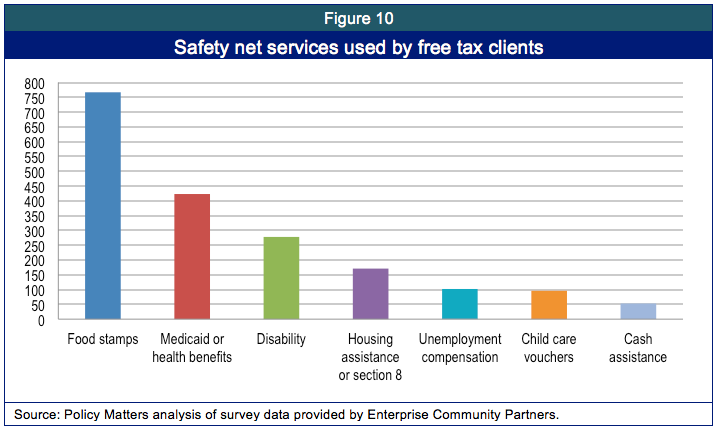

The survey asked about participation in other programs. Figure 10 shows that for the fourth year in a row, the numbers getting help from the safety net rose. More than 750 clients said they received food stamps (now called Supplemental Nutrition and Assistance Program or SNAP), compared to about 420 last year, while more than 400 indicated they received public health assistance, doubling last year’s number of 200. Fewer than 200 clients received unemployment compensation, but Ohio is known for strict eligibility for unemployment, and many of those who are unemployed have been out of work for more than six months and are no longer eligible for benefits. Unemployment compensation and disability payments do not count as earned income and cannot be used to claim the EITC.

Satisfaction

As Table 3 shows, survey results found high levels of satisfaction among clients of the EITC Coalition’s free tax preparation services in 2013: 83 percent agreed or strongly agreed that it was easy to set up an appointment and that they did not have to wait long to be seen; 91 percent agreed or strongly agreed that the tax preparer was professional; 72 percent said they received information about additional useful financial services; and 92 percent deeming it a positive experience. A similar 91 percent said they would return next year.

Demographics

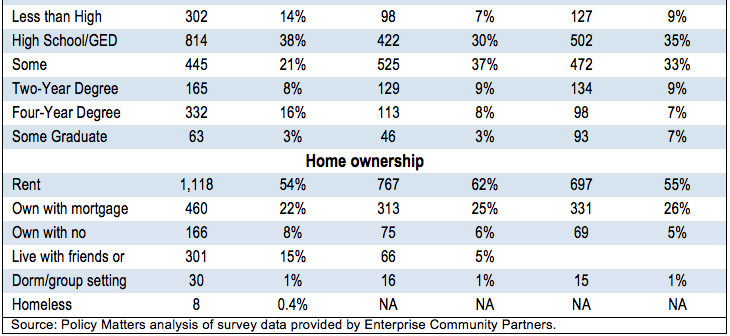

There was little change in demographic characteristics from 2012 to 2013 (see Table 4). The Coalition primarily serves African American (67 percent) and white (19 percent) clients, and serves few Hispanic and Asian clients. More women than men use the services. The number of respondents reporting an education level below high school doubled to 14 percent this year, but the number reporting a college degree also doubled, from 8 to 16 percent. By far the largest share of clients, about 60 percent, have a high school degree or some college but no degree.

More than half the clients rent their homes or apartments, but there was an alarming tripling in the percentage doubling up with friends or family, from 5 percent in 2012 to 15 percent in 2013. The average income for a client was $25,035, though many reported being unemployed or offered incomplete salary information. The average age was 47, a slight increase from previous years. More than 270 clients (11 percent) reported being either evicted or part of a home foreclosure.

Recommendations

The Coalition provides tremendous benefit to Cuyahoga County. It serves nearly 11,000 clients, brings millions of federal dollars home to Cuyahoga County, relieves poverty for thousands of families, and helps clients avoid exploitative fees charged by paid preparers. At the same time, the program, while growing, remains tiny given the area’s population.

Two positive policy changes have already occurred, which should improve outcomes for low-income tax filers. Three additional policy changes and one programmatic change could go much further. The policy recommendations below describe the two helpful first steps and the policy and programmatic paths forward:

- Federal regulators took several steps that together made it no longer viable for banks to issue Refund Anticipation Loans (RALs), which cost Americans more than $1.2 billion in their peak year. Regulators should do more to regulate and require clear disclosure of other fees and products, like Refund Anticipation Checks, which, while not as bad, still cost working Americans hundreds of millions of dollars each year.

- In the recently passed biennial budget, Ohio followed the example of 25 other states and the District of Columbia by enacting a very small state EITC which tax filers can begin to claim starting with their 2014 returns. This is an excellent, if tiny, step in a good direction – low income families pay a higher percentage of their income in state and local taxes; the EITC helps correct for this. This state EITC differs from the federal one in that it is nonrefundable so will provide little or nothing to the lowest-income workers, who owed little or no income tax to begin with. The Ohio Earned Income Tax Credit should be made refundable and increased in size from 5 percent to a 15 or 20 percent level that some other states provide.

- The state, county and city should provide more resources to the Coalition. By bringing federal dollars into the community using mostly volunteer labor, the Coalition provides an incredible return for public resources. With a budget of under $540,000 the Coalition helps bring more than $14.2 million in state and federal resources into Cuyahoga County. This means for each dollar spent, $26 is brought home to our local communities. The Coalition receives generous funding from Cuyahoga County, the Internal Revenue Service, United Way and a variety of financial institutions and non-profits. Despite the excellent return, and even though the Coalition serves more people each year, only 2.6 percent of Cuyahoga County EITC claimants used the Coalition’s services in 2013. While this is much better than the rate in many communities, if we doubled the Coalition’s budget, we could bring more money home to Cuyahoga County, help families avoid exploitative fees, relieve poverty here, and boost our local economy.

- Continue bundling free tax preparation with other vital services for families. The Coalition has done an excellent job of seeking allied organizations as hosts for free tax delivery – for example, taxes are prepared at sites managed by the Cleveland Housing Network, Famicos Foundation, Neighborhood Housing Services of Greater Cleveland, Detroit Shoreway, and Cuyahoga County Job and Family Services. Research, including past iterations of this evaluation, shows that families need help with other basics beyond just help getting their refunds. There’s also ample evidence that bundling services is effective, efficient, increases uptake and increases benefits to families. Continuing to share infrastructure, integrate services, and provide cohesive support to clients will mean that families get the help they need with all the basics – tax refunds, food, housing, utilities, even job training and education. Further integration will help clients and their families maximize the benefits of each of these individual services and learn how these supportive services work even better when they work together.

Authors

Lauren Klingshirn, a research and communications intern at Policy Matters Ohio, is a rising senior at the College of Wooster, studying history and working to earn her teacher’s certificate to teach social studies at the middle or high school level. She enjoys running cross country and track at Wooster.

Shubo Yin, a research intern at Policy Matters Ohio, is a rising senior at Yale University double majoring in Economics and Political Science with a concentration in political economy. At Yale, Shubo does spoken word and martial arts/traditional dance.

A special thanks to Michelle Newman, Natalie Davis, Evan Pelecky, Julia Lauritzen and Zane Eisen for contributing data coordination, data entry and data analysis.

Acknowledgements

We are grateful to Enterprise Community Partners for funding this report. The Wean Foundation, the Cleveland Foundation, and the Ohio Benefit Bank provide generous funding to the Ohio CASH coalition. As always, any errors are the sole responsibility of the authors.

[1] “The Earned Income Tax Credit,” The Center on Budget and Policy Priorities, 1 February 2013, Accessed 3 July 2013, www.cbpp.org/files/policybasics-eitc.pdf.

[2] “Statistics for Tax Returns with EITC,” The Internal Revenue Service, 10 May 2013. Accessed 3 July 2013. www.eitc.irs.gov/central/eitcstats/.

[3] See “The Story Behind the Demise of Refund Anticipation Loans”, a blog from 5-10-12 on the Tax Credits for Working Families blog, http://bit.ly/16Se7uS, accessed July 2013.

[4]Carrns, Ann, “A New Variation of a Costly Tax-Time Offer”, 3/27/13, New York Times blog http://bucks.blogs.nytimes.com/2013/03/27/a-new-variation-of-a-costly-tax-time-offer/, accessed July 2013.

[5] The National Consumer Law Center estimated that RACs cost consumers nationwide about $550 million in 2011, the last year for which they had data, while RALs had cost consumers more than $1.2 billion in their peak year: http://www.nclc.org/images/pdf/high_cost_small_loans/ral/ral-report-2013.pdf.

[6] See www.brookings.edu/research/interactives/eitc. More access to volunteer tax preparation and better regulation and disclosure of what clients are paying for these RACs would enable more Cuyahoga County families to keep their refund for saving or spending on essentials.

[7] The Party's Over for Quickie Tax Loans: But Traps Remain for Unwary Taxpayers - The NCLC/CFA 2012 Refund Anticipation Loan Report, Feb. 2012

[8] For more on the IRS VITA program, visit the IRS free services website at: http://www.irs.gov/individuals/article/-,,id=107626.00.html

[9] See “Connecting Free Tax Preparation and Asset Building: Cuyahoga EITC Coalition Study,” Policy Matters Ohio (January, 2009): www.policymattersohio.org/pdf/FreeTaxPrep2009_0120.pdf

Photo Gallery

1 of 22