High-flying startups don't flock to low-tax states

May 31, 2016

High-flying startups don't flock to low-tax states

May 31, 2016

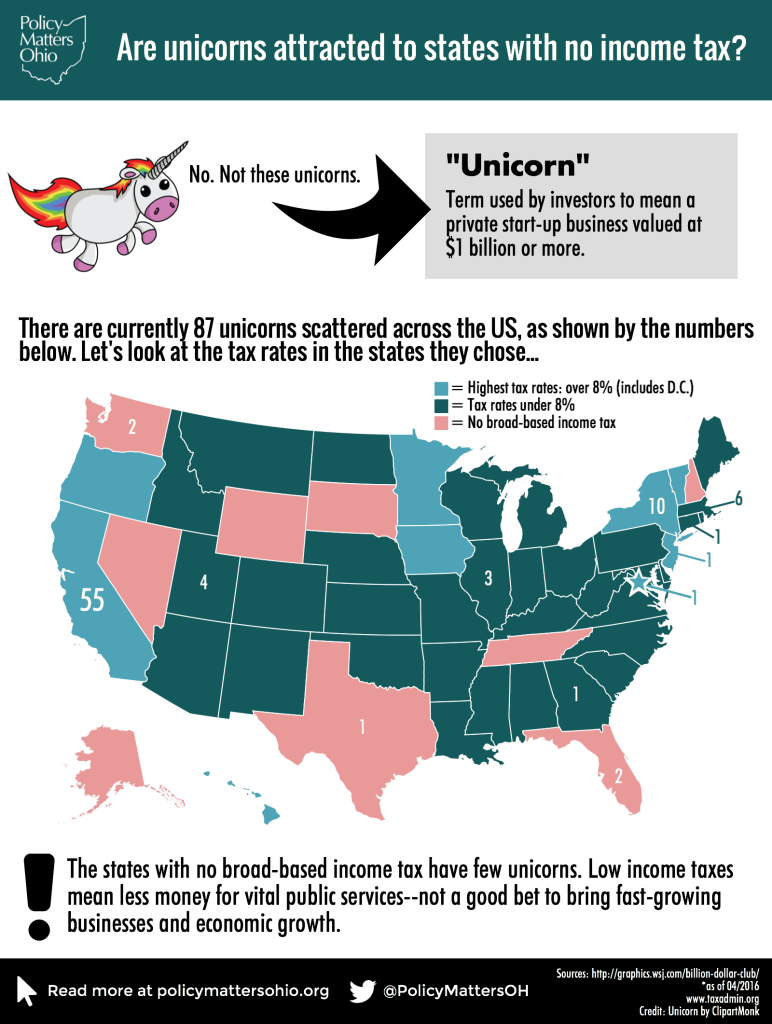

They’re called unicorns, though they’re a little less rare than that.

That’s what Wall Street calls private start-up companies whose investors value them at $1 billion or more. Best-known examples include such companies as Uber, Airbnb, Snapchat and Pinterest.

Policy Matters Ohio took a look at where these companies are located, to see if state income taxes played a role (see graphic).

By far the largest number – a whopping 55 of the 87 U.S.-based companies on a list compiled by the Wall Street Journal in April – are located in California. That state happens to have by far the highest top income-tax rate in the country, at 13.3 percent. Another 10 are in New York State, whose top rate of 8.82 percent ranks 6th highest in the nation, according to the Federation of Tax Administrators. A grand total of five unicorns are based in states without income taxes (Florida, Washington and Texas).

Clearly, income taxes aren’t an impediment to these high flyers.

Of course, one should hardly expect them to be, given that young, fast-growing companies don’t typically make a lot of money. For a variety of reasons, as experts at the Center on Budget and Policy Priorities have noted, cutting taxes is no prescription for economic vitality. In fact, it may stunt growth by reducing investments in education, infrastructure and public services, undercutting efforts to develop a trained workforce and offer a high quality of life.

Some of these firms will never meet their investors’ high expectations and will instead fizzle out. The valuations mark just one point in time; already, some of them have run into trouble. Others may be pursuing business strategies that are, at the least, controversial. And of course, a lot more goes into regional economic success than where these high-profile businesses happen to establish themselves.

However, their locations are one more sign that arguments for lower income taxes may sound simple and convincing, but have little basis in fact.

Zach is Policy Matters research director.

Tags

Zach SchillerPhoto Gallery

1 of 22