House tax plan: A gift to Ohio's wealthiest

April 29, 2015

House tax plan: A gift to Ohio's wealthiest

April 29, 2015

Contact: Zach Schiller, 216.361.9801

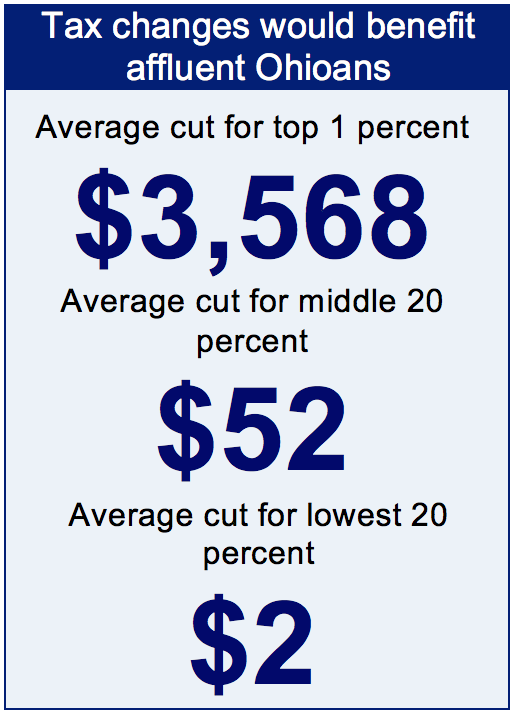

The budget approved by the Ohio House of Representatives last week would deliver thousands of dollars a year in average tax cuts to the most affluent while providing so little to the poorest Ohioans it wouldn’t be enough for a gallon of milk. The average middle-income resident would get enough to buy a six-slice toaster oven.

The budget approved by the Ohio House of Representatives last week would deliver thousands of dollars a year in average tax cuts to the most affluent while providing so little to the poorest Ohioans it wouldn’t be enough for a gallon of milk. The average middle-income resident would get enough to buy a six-slice toaster oven.

The House tax plan includes a 6.3 percent across-the-board cut in income-tax rates, an expansion of an existing tax break for business owners, and the limitation of Social Security income-tax deduction and four retirement income or senior credits to those with below $100,00 in annual income. It differs substantially from the proposal Gov. Kasich offered, which called for a 23 percent income-tax rate cut, higher personal exemptions for those making less than $80,000, a larger and different business tax break, and a number of tax increases to help pay for the bigger income-tax reductions.

The analysis found that the proposal would provide a $3,568 annual tax cut on average to taxpayers in the top 1 percent of the income spectrum, who made more than $388,000 in 2014. The bottom fifth of Ohio taxpayers, who made less than $20,000 last year, on average would see just a $2 reduction. Most of this group would see no benefit at all because many of the poorest Ohioans pay little or no state income tax, though overall they pay more of their income in state and local taxes than more affluent Ohioans do. Middle-income Ohioans making between $37,000 and $58,000 on average would get just a $52 annual tax cut under the bill.

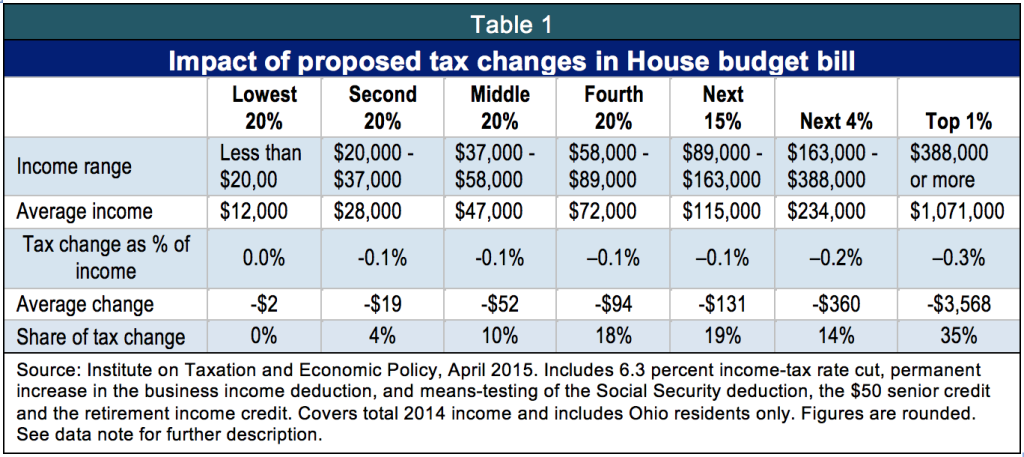

Table 1 provides the breakdown of the overall impact of the major changes in the House bill:

The biggest element in the House bill, and its tilt in favor of upper-income Ohioans, is the income-tax rate cut. However, means-testing of the Social Security deduction and retirement and senior credits is a worthwhile step. It will make the tax system fairer and is financially responsible, as it preserves revenue as the population ages. But it merely reduces the windfall in the tax plan for Ohio’s wealthiest, and instead of supporting these tax cuts should be used to support vital public services.

Expanding the business income deduction first approved in 2013 also will further weight the tax system against low- and middle-income Ohioans. During the first year the existing deduction was in effect, the 6 percent of those claiming the break with business income of $200,000 or more received more than a third of the total tax break.[1] Yet the tax break is poorly targeted and can’t be expected to result in much job creation. Over the 21 months since the tax break was approved, Ohio jobs have grown no faster than they did in the 21 months preceding that – in fact, the growth actually has been slightly slower.[2] New employment at Ohio companies hiring for the first time, which grew somewhat after the economic slump, fell in the first half of 2014 from a year earlier.[3]

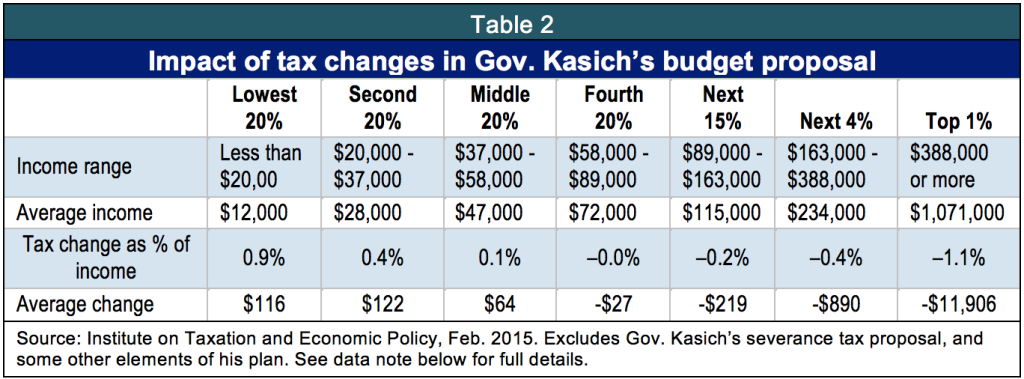

The House tax plan does not shift who pays taxes to lower- and middle-income Ohioans to the same degree as Gov. Kasich’s original tax proposal. As shown previously,[4] under his plan, the top 1 percent would average an annual gain of $11,906, while the bottom 60 percent of Ohioans as a group would pay more. Table 2, based on an earlier analysis ITEP did of the Kasich plan, breaks out how it would affect those in different income groups:

However, though the House bill reduces the income-tax cuts, it would more than double the size of the total net tax cut to $1.2 billion over two years compared to Gov. Kasich’s plan.[5] Ohio can ill afford such tax cuts, which will go mostly to well-off Ohioans, when we have gaping needs. We need to restore aid to local governments. We need to help more of our young people afford college. We need to help more families pay for childcare, so the parents can work. We languish near the bottom among states in public health indicators. These are just a few of our unmet needs.[6]

Moreover, the House plan is based on more optimistic revenue projections than Gov. Kasich’s proposed budget. The House used baseline projections for Fiscal Years 2016 and 2017 from the Legislative Service Commission, which call for greater revenue than those from the administration’s Office of Budget and Management.[7] OBM Director Tim Keen did not specifically revise his projections downward during testimony to the Senate Finance Committee last week, but he cautioned that the economic growth forecast by Global Insight had been slightly reduced over the last three months. “Although these revisions are not large,” Keen said, “they have the potential to exert downward pressure on the updated revenue forecast presented to the budget conference committee.”[8] A final forecast is presented to the conference committee in June before the budget is finalized.

Income-tax cuts flow heavily to the most affluent, further increasing inequality in Ohio. A separate ITEP analysis issued in January 2015 found that overall, nonelderly Ohioans in the top 1 percent pay considerably less of their income in state and local taxes than middle-class and poor Ohioans do.[9] Previous income-tax rate cuts have done little for our economy.[10] In June 2005, the Ohio General Assembly approved a 21 percent phased-in reduction of income-tax rates; the cuts were increased further in 2013. Since June 2005, Ohio has lost 0.5 percent of its jobs, while the nation as a whole has grown by 5.4 percent. The House tax plan needs a makeover.

[1] Calculations are based on data from the Ohio Department of Taxation as of March 18, 2015. Figures include claims through that date.

[2] The number of Ohio jobs grew by 129,700 between June 2013 and March 2015, or 2.47 percent. During the previous 21 months, they grew by 133,000, or 2.60 percent. By contrast, U.S. jobs grew faster during the more recent period than they did in the earlier one. U.S. Department of Labor, Bureau of Labor Statistics, State and Area Employment, Hours and Earnings, at http://data.bls.gov/cgi-bin/surveymost?sm+39

[3] Schiller, Zach, “Business Tax Break Proposal: Costly, Unfocused and Unlikely to Bring New Jobs,” Policy Matters Ohio, p. 4, at http://www.policymattersohio.org/business-tax-april2015

[4] Schiller, Zach, “Kasich tax proposal would skew tax system even more in favor of Ohio’s affluent,” Policy Matters Ohio, Feb. 10, 2015, at http://www.policymattersohio.org/kasich-tax-proposal-feb2015

[5] Gov. Kasich’s plan calls for overall state tax cuts of $810 million over two years. However, because of his proposals to broaden the base of the sales tax, which is also levied by counties and transit agencies, and share higher severance tax revenue with localities, the total net state and local tax cut was estimated at $523 million.

[6] For a partial list of Ohio’s needs, see Wendy Patton, “An Investment Budget for Ohio,” Policy Matters Ohio, March 18, 2015, at http://www.policymattersohio.org/invest-march2015

[7] Flanders, Mark, Director, Legislative Service Commission, “Baseline Forecast of GRF Revenues and Medicaid Expenditures for the FY 2016-FY 2017 Biennial Budget,” Testimony Before the Senate Finance Committee, Apr. 21, 2015, at http://www.ohiosenate.gov/committee/finance#

[8] Keen, Timothy S., Office of Budget and Management, “House Bill 64—Governor Kasich’s Budget Recommendations for Fiscal Years 2016 and 2017, Senate Finance Committee, Apr. 21, 2015, at http://www.ohiosenate.gov/committee/finance#

[9] Patton, Wendy, “Ohio State and Local Taxes Hit Poor and Middle Class the Hardest,” Policy Matters Ohio, Jan. 14, 2015, at http://www.policymattersohio.org/tax-report-jan2015

[10] Schiller, Zach, “Income-Tax Cuts: Bad Medicine for Ohio,” Policy Matters Ohio, March 3, 2015,at http://www.policymattersohio.org/income-tax-cuts-march2015

Tags

2015ITEPTax ExpendituresTax PolicyZach SchillerPhoto Gallery

1 of 22