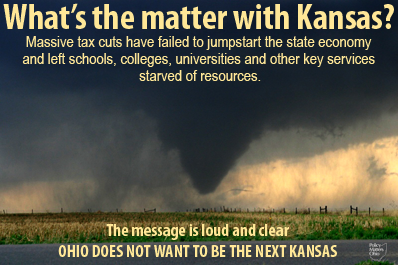

Lessons for Ohio from Kansas' Massive Tax Cut

March 27, 2014

Lessons for Ohio from Kansas' Massive Tax Cut

March 27, 2014

Read the full report by the Center on Budget and Policy Priorities here.The tax cuts enacted in Kansas in 2012, among the largest ever enacted by any state, are a cautionary tale. As other states recover from the recent recession and turn toward the future, Kansas’ huge tax cuts have left that state’s schools and other public services stuck in the recession, and declining further — a serious threat to the state’s long-term economic vitality. Meanwhile, promises of immediate economic improvement have utterly failed to materialize.

According to CBPP, as other states consider large tax cuts, they should heed these key lessons from Kansas:

According to CBPP, as other states consider large tax cuts, they should heed these key lessons from Kansas:

▪ Deep income tax cuts caused large revenue losses. Kansas’ tax cuts this year are costing the state about 8 percent of the revenue it uses to fund schools, health care, and other public services, a hit comparable to a mid-sized recession. State data show that the revenue loss will rise to 16 percent in five years if the tax cuts are not reversed.

▪ The large revenue losses extended and deepened the recession’s damage to schools and other state services. Most states are restoring funding for schools after years of significant cuts, but in Kansas the cuts continue. Governor Sam Brownback recently proposed another reduction in per-pupil general school aid for next year, which would leave funding 17 percent below pre-recession levels. Funding for other services — colleges and universities, libraries, and local health departments, among others — also is way down, and declining.

▪ The tax cuts delivered lopsided benefits to the wealthy. Kansas’ tax cuts didn’t benefit everyone. Most of the benefits went to high-income households. Kansas even raised taxes for low-income families to offset a portion of the revenue loss; otherwise the cuts to schools and other services would have been greater still.

▪ Kansas’ tax cuts haven’t boosted its economy. Since the tax cuts took effect at the beginning of 2013, Kansas has added jobs at a pace modestly slower than the country as a whole. The earnings and incomes of Kansans have performed slightly worse than the U.S. as a whole as well. (An exception is farmers, whose incomes improved as the state recovered from a drought.) And so far there’s no evidence that Kansas is enjoying exceptional business growth: the number of registered business grew more slowly last year than in 2012, and the state’s share of all U.S. business establishments fell over the first three quarters of last year, the latest data available.

▪ There’s little evidence to suggest that Kansas’ tax cuts will improve its economy in the future. No one knows for certain how Kansas’ economy will perform in the years ahead, but it isn’t likely to stand out from other states. The latest official state revenue forecast, from November 2013, projects Kansas personal income will grow more slowly than total national personal income in 2014 and 2015.

Evidence from other states and academic studies casts further doubt on claims that the tax cuts will cause the state’s economy to boom. States that cut taxes the most in the 1990s performed worse, on average, over the course of the next economic cycle than states that were more prudent. And the academic literature overwhelmingly finds that states with lower personal income taxes perform no better economically than their peers.

Tags

2014Revenue & BudgetTax ExpendituresTax PolicyPhoto Gallery

1 of 22