Local governments may see modest funding boost, but still deep in the hole

April 06, 2015

Local governments may see modest funding boost, but still deep in the hole

April 06, 2015

Contact: Wendy Patton, 614.221.4505

By Wendy Patton

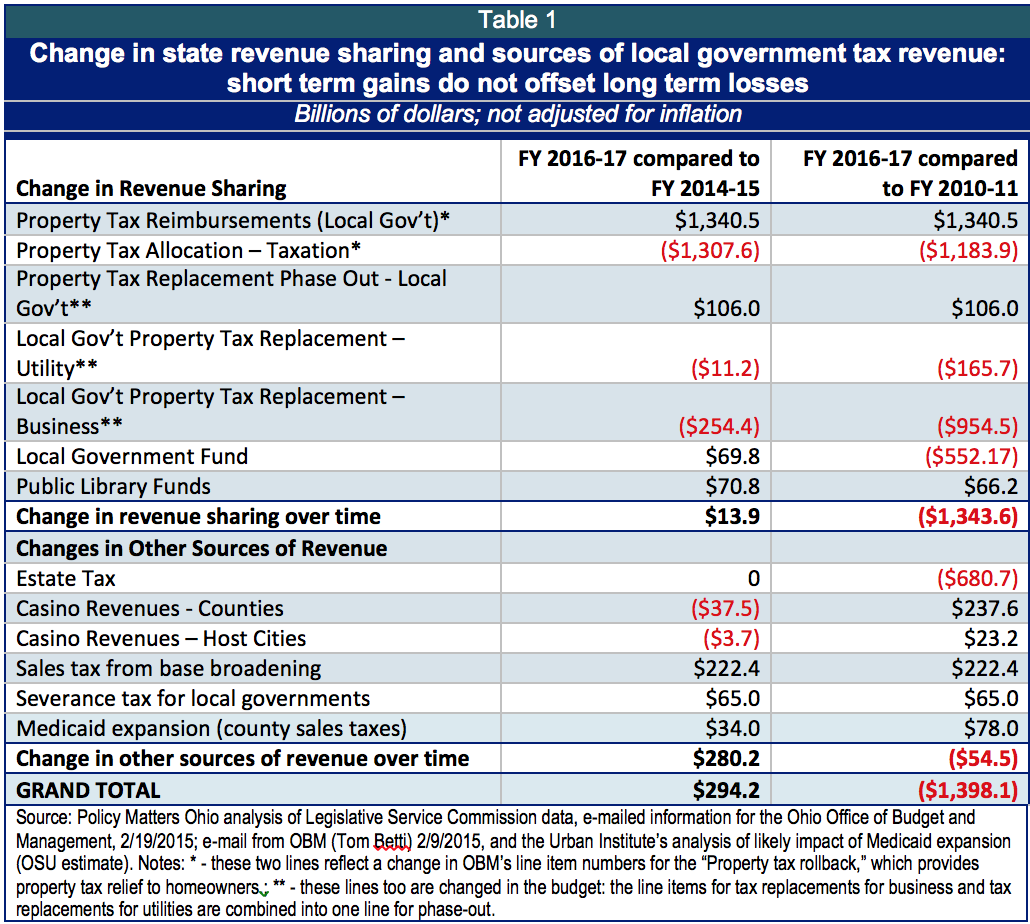

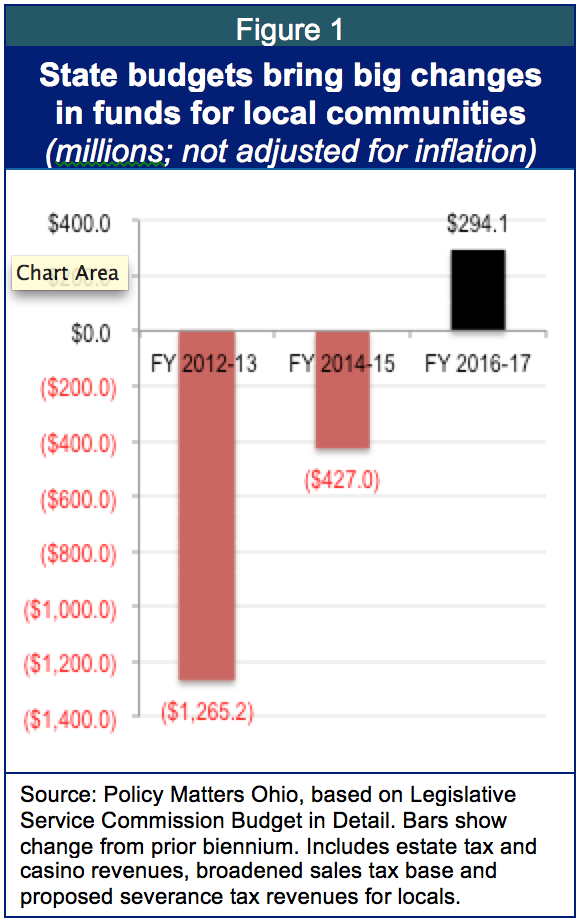

Revenues for local governments increase in the executive budget for fiscal year 2016-17 compared with the current budget. But the increase is small compared to earlier losses, leaving local communities still $1.4 billion short of where they were five years ago.

Revenues for local governments increase in the executive budget for fiscal year 2016-17 compared with the current budget. But the increase is small compared to earlier losses, leaving local communities still $1.4 billion short of where they were five years ago.

The modest revenue increases also would not apply to local governments evenly. A sales tax increase will not help cities, villages, townships and special districts, which don’t have sales tax (counties and transit agencies can impose a sales tax). Severance tax from oil and gas well drilling will benefit only communities with drilling, as the tax is intended for infrastructure needs in those areas. Many communities will see additional cuts in state aid.

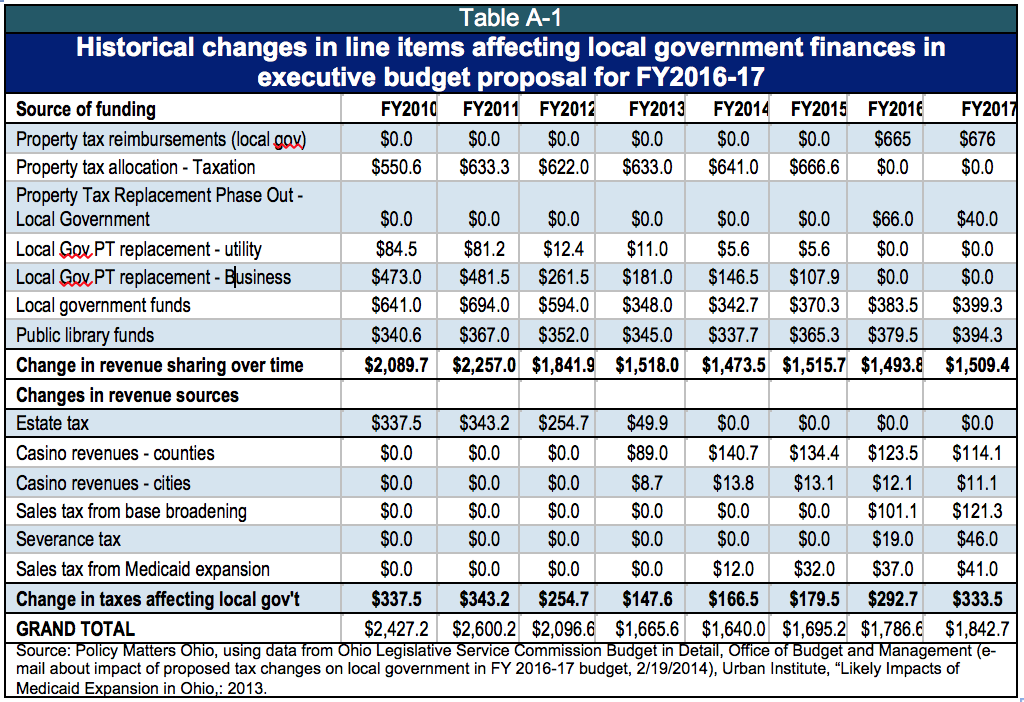

Three blows to local government

The largest loss to Ohio’s local governments occurred in the 2012-13 budget with a 50 percent reduction in the Local Government Fund, further cuts in the (already greatly reduced) Public Library Fund, phase-out of tax reimbursements (promised when local property taxes on business and utility machinery and equipment were eliminated in the last decade) and elimination of the estate tax. In that budget period alone, local governments lost $1.27 billion dollars compared to the prior biennial budget (Figure 1). In the budget for FY 2014-15, local government lost another $427 billion.

No jurisdiction has been untouched by this loss. Some communities dimmed streetlights in neighborhoods; many laid off safety and emergency forces. Many jurisdictions helped neighboring communities that lacked staff and equipment to respond to 911 calls. “When one island starts to sink, the entire archipelago is endangered,” said Councilman James O’Reilly of Wyoming, outside of Cincinnati, explaining why his police, fire and ambulance crews responded to calls of nearby communities.[1]

New economic growth has not increased property tax revenues, the backbone of local government and school finance, although local property tax rates have increased. The state forecast last fall that the value of taxable property will not return to the level of 2008, the first full year of the recession, until 2017.[2] Casino revenues, voted in as part of the constitutional amendment that allowed gambling in Ohio, have not replaced other losses.

New economic growth has not increased property tax revenues, the backbone of local government and school finance, although local property tax rates have increased. The state forecast last fall that the value of taxable property will not return to the level of 2008, the first full year of the recession, until 2017.[2] Casino revenues, voted in as part of the constitutional amendment that allowed gambling in Ohio, have not replaced other losses.

The executive budget proposal for FY 2016-17 would eliminate most “tax reimbursements,” a form of revenue sharing that dates back 15 years to reduction or elimination of local taxes on tangible personal property (machinery and equipment).[3] Tangible personal property was a big part of the local tax base. When the tax was initially phased out, reimbursement was promised for a number of years, ostensibly until economic growth would replace the loss.

Tax reimbursements were eliminated or deeply reduced for local government entities in the budget for FY 2012 and 2013. Remaining reimbursements were frozen in 2013, but this year’s executive budget would resume the phase-out. For most levies, local government tax reimbursements for public utility property tax and for tangible personal property tax will end by 2019.[4]

Many local governments have already lost their tax reimbursements. Some other face significant losses now. There are currently 1069 local government entities receiving tax reimbursements. By 2017, 660 of those will have lost tax reimbursements. This will affect 28 county levies, 341 municipalities (cities and villages), 207 townships and 81 special districts.[5]

Local governments in Allen County, a heavily industrial area that once had significant tangible personal property tax revenue, face problematic funding declines. Todd Truesdale, the Fire Chief for Shawnee Township, explained to the House Ways and Means committee that as part of the Ohio Fire Emergency Response System, the Shawnee Township Fire Department makes up a third of the regional response for hazardous materials and foam firefighting needs in the region. Aging or limited equipment, technology or materials can lead to a rise in insurance prices for industrial users dependent on their firefighting services.[6]

The mental health board of Lima County, facing phase-out of tax reimbursements, fears they will have to lay off the four life coaches that help 250 residents recover from illness and addiction. The Department of Developmental Disabilities estimates they will be able to help 100 fewer families if they lose the tax reimbursement streams.[7]

New local revenues for local governments proposed in HB 64

The expansion of the sales tax base proposed in the governor’s proposed budget would extend that state tax to a number of services that currently are not taxed. Because local taxes piggyback on the state tax structure, the local sales tax base would expand as well. Sales taxes would be applied to professional services, including management consulting, lobbying, market research and polling, public relations and debt collection services as well as to cable television subscriptions, parking and travel services. In addition, two other sales-tax breaks would be reduced. The Ohio Office of Budget and Management estimates this will bring $101.1 million to local governments in FY 2016 and $121.3 in FY 2017,[8] totaling $222.4 million over the biennium (Table 1). This will benefit counties and transit agencies, which are allowed to levy a local sales tax.

Because sales taxes apply to some services under Medicaid expansion, reauthorization of Ohio’s Medicaid program with current eligibility preserved, including those included in the expansion, would also boost county sales tax collections by an estimated $37 million in 2016 and $41 million in FY 2017.[9]

The proposed severance tax on fracking – 6.5 percent of value on dry gas and oil and 4.5 percent on natural gas liquids – would help counties affected by drilling. Under the governor’s proposal, 20 percent of severance tax proceeds would be given to counties. Ten percent would be distributed based on the number of oil and gas wells: County budget commissions would distribute the money within the county. Another 5 percent would go to a shale region infrastructure fund, and 5 percent to a long-term endowment fund. The executive budget proposal for FY 2016-17 estimates localities will receive $19 million in FY 2016 and $46 million in FY 2017 and thereafter.[10]

Table 1 shows the difference in funds proposed for FY 2016-17 compared to FY 2014-15. It also shows the change in funding in FY 2016-17 compared to FY 2010-11, the last year before major changes in revenue sharing, tax reimbursements, estate tax and casino revenues were enacted. Over time, the $294 million gain in the proposed budget is a small restoration after five years of heavy loss. (See Table A-1 in the appendix for data on separate years).

The tax sources that raise revenues for local government in the budget proposal have been proposed before and hotly contested since Kasich became governor. The Governor has proposed expanding the sales tax base in previous budgets, but legislators have, for the most part, rejected that approach after hearing from industry lobbyists. Resistance is similar to the severance tax proposal. The powerful oil and gas industry has long battled severance taxes on high volume drilling that involves hydraulic fracturing of shale rock (“fracking”). The Governor, the fracking industry and former state Senator Robert Hagan have each proposed legislation to expand the severance tax, but no proposal has made it through the legislature even though costs to the state and to local governments are increasing as a result of the drilling.[11]

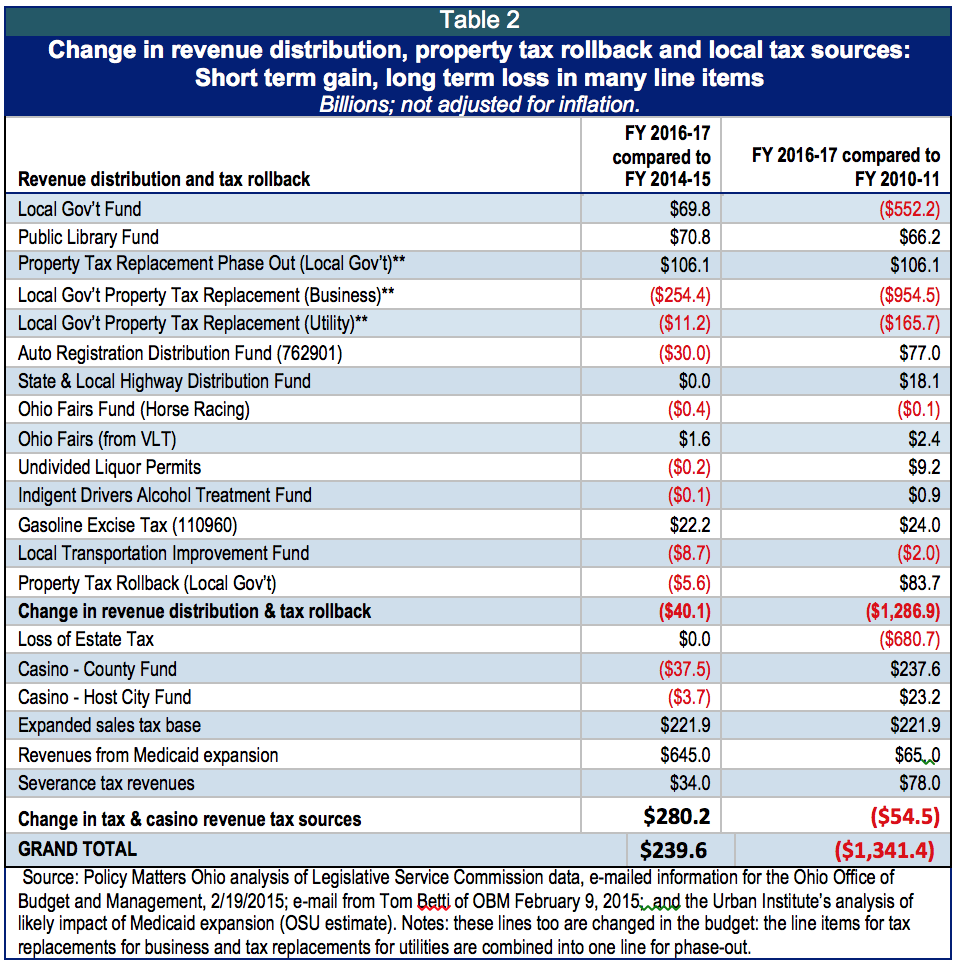

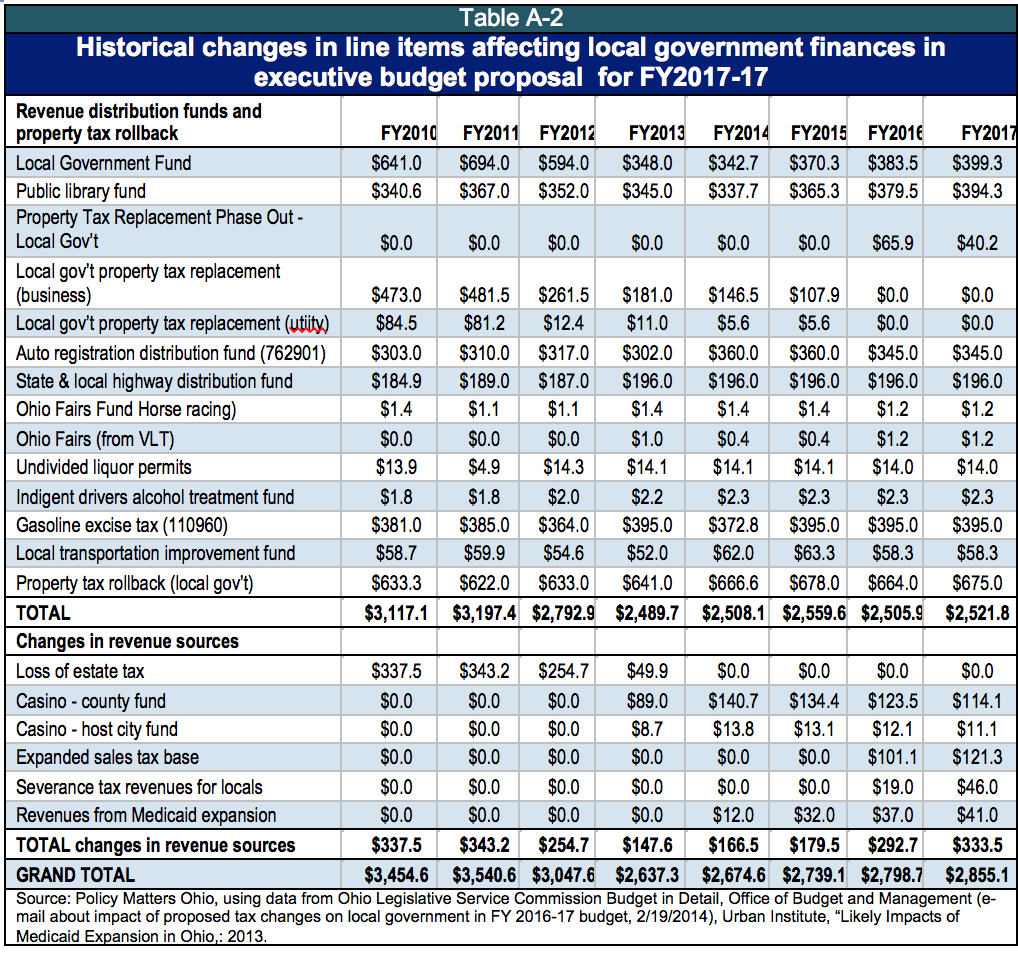

In Table 2, we look at the change in funding across all 13 line items relevant to local government funding from “Factsheet: Funding Ohio Communities,” a document produced by the Office of Budget and Management in 2013. We compare funding proposed for the two-year budget in FY 2016-17 with biennial funding in the current year budget, FY 2014-15. We also compare funding levels proposed for the FY 2016-17 budget with that of FY 2010-11. (See Table A-2 in the Appendix for data on the separate years). We do this to see if gains in other revenue lines untouched by policy changes affect overall gain or loss to Ohio communities.

Across all lines identified as relevant to state revenue distribution to local governments, including the property tax rollback, funds fall by $40 million in FY 2016-17 compared to the current budget period, but changes in sales and severance taxes offset the loss. Over this short period, communities will come out $240 million ahead, across all line items because of the local tax increases described above. From this perspective, across all revenue distribution sources, the property tax rollback and key tax and tax sources eliminated and expanded, local government will have lost $1.3 billion in the biennial budget for FY 2016-17 compared to the two-year budget period in FY 2010-11.

Summary and conclusion

Ohio’s economy has not rebounded from the recession. Ongoing cuts hamper recovery and restoration. More than 42,000 local government jobs have vanished from Ohio’s communities since 2008. Needs in many areas are higher because of foreclosed and abandoned properties that need to be demolished or rehabilitated, but resources that allow localities to restore neighborhoods and carry on basic services are diminished. Lack of state funding and strain on local resources causes communities to lose out on other opportunities. A transit needs study conducted by the Ohio Department of Transportation last year concluded:

“Without state and local funds, federal funds are going unspent. As of July 2014, there is nearly $21 million in federal funds available to Ohio’s transit agencies that cannot be spent due to a lack of local match. This is a significant opportunity cost for many of Ohio’s small urban and rural communities.“[12]

Tax changes in 2005 were to bring about economic growth, but that has not happened. The plans laid in 2005 to phase out tax reimbursements did not include a major recession and lingering damage to the property tax base. The gains in tax revenues to some localities in the current budget proposal are a step in the right direction, but more is needed. Lawmakers should reverse cuts and reinvest in Ohio’s local communities. It is time for a new view of state and local financial relations that strengthens communities rather than draining them.

APPENDIX

[1] Wendy Patton, “Intensifying Impact,” Policy Matters Ohio, November 2013 at http://www.policymattersohio.org/intensifying-impact

[2] Wendy Patton and Zach Schiller, Hard Times at City Hall, Policy Matters Ohio, January 2015 at http://www.policymattersohio.org/hard-times-jan2015

[3] Taxes on utility tangible personal property were reduced with deregulation in the early years of the past decade, while the tax on business tangible personal property was eliminated in the budget bill for 2005, House Bill 66, and phased out completely.

[4] According to the Ohio Office of Budget and Management (citation above), the executive budget proposal would maintain the HB 66 need to say what HB 66 is treatment of bond levies, i.e. reimbursement continues as long as the levy is in effect, until the debt is retired. It would also maintain the HB 66 treatment of inside millage debt levies, i.e. reimbursement goes to zero in either FY 2017 (for utility deregulation) or FY 2019 (for TPP).

[5] Ohio Office of Budget and Management, cited above, Table 2.

[6] Testimony of fire chief Todd Truesdale of the Shawnee Township Fire Department, March 10 2015.

[7] These figures were provided at an editorial board roundtable with the Lima News on May 23, 2015. Chris Karcz of the Allen County Mental Health Recovery Services Board and Esther Balderidge of the Allen County Board of Developmental Disabilities provided the figures cited here.

[8] E-mailed communication between Ohio Office of Budget and Management and Zach Schiller of Policy Matters Ohio, February 19, 2015.

[9] The Urban Institute, “Expanding Medicaid in Ohio: Analysis of Likely Effect,” February 2013 (Table 13: OSU estimate for 2014, 2015, 2016 and 2017) at http://www.urban.org/uploadedpdf/412772-Expanding-Medicaid-in-Ohio-Report.pdf Note: this is not a fiscal year estimate, and it was an early (2013) estimate.

[10] “Blueprint for a New Ohio: Budget Recommendations, State of Ohio executive budget for fiscal years 2016-17,” Office of Budget and Management, p.B-25, at http://www.blueprint.ohio.gov/doc/budget/State_of_Ohio_Budget_Recommendations_FY-16-17.pdf (Accessed April 3, 2015).

[11] Amanda Woodrum, “Fracking in Carroll County: An Impact Assessment,” Policy Matters Ohio, April 2014 at http://www.policymattersohio.org/wp-content/uploads/2014/04/Shale_Apr2014.pdf

[12] Ohio statewide transit needs study at http://www.dot.state.oh.us/Divisions/Planning/Transit/TransitNeedsStudy/Documents/TransitFunding.pdf

Tags

2015Budget PolicyLocal GovernmentMedicaidWendy PattonPhoto Gallery

1 of 22